-

BIST 100

11498,38%0,00En Düşük11296,52En Yüksek11498,38

11498,38%0,00En Düşük11296,52En Yüksek11498,38 -

DOLAR

43,04%0,04Alış43,0345Satış43,0445En Yüksek43,0524

43,04%0,04Alış43,0345Satış43,0445En Yüksek43,0524 -

EURO

50,32%-0,18Alış50,2995Satış50,3366En Yüksek50,4892

50,32%-0,18Alış50,2995Satış50,3366En Yüksek50,4892 -

EUR/USD

1,17%-0,35Alış1,1682Satış1,1682En Yüksek1,1725

1,17%-0,35Alış1,1682Satış1,1682En Yüksek1,1725 -

ALTIN

6095,78%1,66Alış6095,07Satış6096,49En Yüksek6116,92

6095,78%1,66Alış6095,07Satış6096,49En Yüksek6116,92

-

BIST 100

11498,38%0,00En Düşük11296,52En Yüksek11498,38

11498,38%0,00En Düşük11296,52En Yüksek11498,38 -

DOLAR

43,04%0,04Alış43,0345Satış43,0445En Yüksek43,0524

43,04%0,04Alış43,0345Satış43,0445En Yüksek43,0524 -

EURO

50,32%-0,18Alış50,2995Satış50,3366En Yüksek50,4892

50,32%-0,18Alış50,2995Satış50,3366En Yüksek50,4892 -

EUR/USD

1,17%-0,35Alış1,1682Satış1,1682En Yüksek1,1725

1,17%-0,35Alış1,1682Satış1,1682En Yüksek1,1725 -

ALTIN

6095,78%1,66Alış6095,07Satış6096,49En Yüksek6116,92

6095,78%1,66Alış6095,07Satış6096,49En Yüksek6116,92

- Anasayfa

- Haberler

- Tüm Haberler

- There will be a huge boom

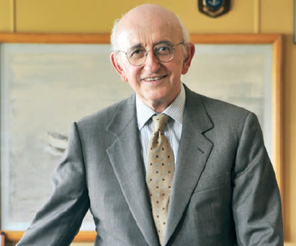

There will be a huge boom

The maritime sector is one of the investment areas that is attracting the attention of the big bosses.

The maritime sector is one of the investment areas that is attracting the attention of the big bosses. In recent years, many bosses such as Ömer Sabancı, Turgay Ciner and İmam Altınbaş have made investments in this sector. Pekin Baran is pleased with this interest, noting: "It is very good that people with such resources, such as Sabancı and Karamehmet, have entered the sector." He notes that maritime transportation has shifted to China and the Far East, and adds: "The fact that the countries of Asia are developing so rapidly is a big advantage for the maritime sector. There will be huge boom in demand." We spoke with Pekin Baran, who is one of the leading names in the maritime sector, about new investments and the future.

Capital: What kind of future awaits the maritime sector? Where do you think growth will come from?

- Now there is the increasingly powerful China factor. This has created a significant change in the composition of the maritime transportation sector. In the world as a whole, maritime transportation is shifting towards the Far East and China. In 2002, China accounted for 11 percent of imports of coal and mineral ores. By 2010, China's share had risen to 38 percent. This more than threefold increase is driving important macroeconomic and geopolitical changes. In fact, there is a shift in global trade towards China and the Far East in general but this will affect maritime transportation less than other sectors. Because the problem in the maritime sector is the disruption in the balance of supply and demand. This is not the first time it has happened and it is a reality of the maritime sector that whichever country develops will eventually need maritime transportation. For this reason, the rapid development of the countries of Asia is a great advantage for the maritime sector. There will be a huge boom in demand. I think that the disruption in the balance of supply and demand will begin to right itself in two years' time.

Capital: How do you see the major investments that have been made in this area in Turkey over the last ten years?

- There have been many investments in Turkey over the last ten years. I think that these are very healthy developments... The entry of powerful players such as Sabancı and Karamehmet into the sector and the launch of large investments has been very good. In fact, Karamehmet has been in the sector since the 1970s, but he made a very good investment at a time when freight costs rose. He managed that period very well.

Capital: There must be reasons for this level of demand in the sector. Is it a sector with high rates of profitability?

- The answer today to the question of why investments are being made is not profits. The profits were in the past or will be in the future. In 2007, the daily lease of a 120-150,000 dwt bulk carrier rose to $120,000. Our vessels are smaller. We didn't regard $50,000 as being worth the trouble. In September 2008, the daily rate for the same 120-150,000 dwt vessel was $1,000. I mean, in one year the lease rate fell from $120,000 to $1,000. This is a very good summary of the maritime transportation sector. This business is incredibly periodic... When freight prices rise, you are incredibly happy and you make a lot of profit. But you can have similar sorrows when prices fall. One must look at who plays the game and how.~

Capital: What is the minimum investment needed to enter the maritime sector?

- The figure depends on the size of the ship that you want to buy... Today, a ship of 120-150,000 dwt costs $38 million. In the past you used to be able to enter the business with a ship like this, but it isn't really possible anymore. You need to come in with more capital. You need to start with at least two vessels. In the past, ship-owning used to be seen as one of the professions which needed the most capital and which it was most difficult to enter. It is still the same... In the end, you are buying a floating factory.

Capital: How long does it take before you get your investment back?

- If you had bought a vessel two years ago, then you could have got your investment back in 6-7 year. But today it takes at least ten years to get a return. For this reason, the first rule in our profession is timing. The time when you are going to buy a ship becomes very important.

Capital: Have recent investments resulted in a change in which Turkish ship-owning is perceived in the global maritime sector?

- These investments have been very good from the perspective of global perceptions of the Turkish maritime sector. The influence of your profession in the global arena varies according to the turnover in the sector. Turkey and Turkish companies have begun to attract more attention in this respect. But, of course, this change has increased the sector's need for professional personnel.

Capital: What needs to be done in order to increase our global influence?

- The sector now has a strong infrastructure. The Turkish Maritime Foundation (TÜDEV) school was converted into a university two years ago. A good education creates good human resources. The structure of the sector has become more liberalized. Personally, I think that the Turkish maritime sector has passed through a significant stage. For example, there have been no major bankruptcies in this sector in Turkey. In Greece and in Germany there has been a bloodbath. This is a great success... But I believe that today we have shortcomings when it comes to a professional workforce.

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?