-

BIST 100

13821,97%0,49En Düşük13821,97En Yüksek0

13821,97%0,49En Düşük13821,97En Yüksek0 -

DOLAR

43,99%0,06Alış43,97Satış43,99En Yüksek43,99

43,99%0,06Alış43,97Satış43,99En Yüksek43,99 -

EURO

50,94%-0,97Alış50,92Satış50,94En Yüksek51,53

50,94%-0,97Alış50,92Satış50,94En Yüksek51,53 -

STERLİN

58,56%-0,7Alış58,53Satış58,56En Yüksek59,09

58,56%-0,7Alış58,53Satış58,56En Yüksek59,09 -

ALTIN

7650%-2,24Alış7223,42Satış7650En Yüksek7825

7650%-2,24Alış7223,42Satış7650En Yüksek7825

-

BIST 100

0%0,49En Düşük0En Yüksek0

0%0,49En Düşük0En Yüksek0 -

DOLAR

43,98%0,06Alış43,97Satış43,99En Yüksek43,99

43,98%0,06Alış43,97Satış43,99En Yüksek43,99 -

EURO

50,93%-0,97Alış50,92Satış50,94En Yüksek51,53

50,93%-0,97Alış50,92Satış50,94En Yüksek51,53 -

STERLİN

58,54%-0,7Alış58,53Satış58,56En Yüksek59,09

58,54%-0,7Alış58,53Satış58,56En Yüksek59,09 -

ALTIN

0%-2,24Alış7223,42Satış7650En Yüksek7825

0%-2,24Alış7223,42Satış7650En Yüksek7825

- Anasayfa

- Haberler

- Tüm Haberler

- The dangerous squeeze

The dangerous squeeze

In the last year, there has been a steep rise in the number of companies in diverse sectors seeking suspended bankruptcies, from Rodi to the generator giant the Kırcı Group, the pulses giant Narpa Narin and Verde Yağ.

12.06.2014 13:34:510

Over the last year there has been an increase in suspended bankruptcies. Those who have taken this path include some very important players in their sectors, such as Rodi, the Kırcı Group, Narpa Narin and Verde Yağ. Experts say that the problem that has brought companies to the brink of collapse is a lack of liquidity.

This situation is expected to continue until the end of the year, leaving executives face to face with deadly risks such as a rising exchange rate and a lack of profits, revenue and liquidity.

Tabloyu görmek için görsele tıklayın.

Compared, with last year, there has been a 100 per cent increase in the number of my clients who have been coming to me with requests for bankruptcy. Most demand is coming from the construction sector, its supply industries, and foodstuffs companies.

Compared, with last year, there has been a 100 per cent increase in the number of my clients who have been coming to me with requests for bankruptcy. Most demand is coming from the construction sector, its supply industries, and foodstuffs companies.

The major cause of companies reaching this point is liquidity squeezes. They do not have sufficient equity capital. In order to the costs of bank loans they are using factoring companies to discount the checks they have received on their low profits. This is how they are trying to pay their debts to banks.”

These words belong to the lawyer Ali Rıza Yılmaz, who handles suspended bankruptcy cases. The companies that have come to Yılmaz’s attention through their liquidity shortages and which have come to the brink of bankruptcy are not confined to the construction and foodstuffs sectors.

In the last year, there has been a steep rise in the number of companies in diverse sectors seeking suspended bankruptcies, from Rodi to the generator giant the Kırcı Group, the pulses giant Narpa Narin and Verde Yağ.~

It is striking that the basic problem that is bringing companies to the brink of bankruptcy is a shortage of liquidity. This situation is expected to continue until the end of the year, leaving executives face to face with deadly risks such as a rising exchange rate and a lack of profits, revenue and liquidity.

500,000 COMPANIES WENT UNDER

A shortage of liquidity also played the leading role in the global financial crisis that erupted at the end of 2008. The value of the global economy was $60 trillion and the market value was around $600 trillion.

The liquidity problem appeared as a result of the mortgage crisis that began in the USA. At that time, the first bankruptcy as a result of liquidity problems was the $2.6 billion investment bank Bearn Sterns. Later came Basis Capital and the process continued with Absolute Capital, the use of state aid to rescue Fannie Mae and Freddie Mac and the nationalization of investment banks.

The bankruptcy of Lehman Brothers increased the global financial crisis’s liquidity problem. Dr. ismet Demirkol, who is a member of the teaching staff at Bahge§ehir University, says that, during the same process, nearly 500,000 companies collapsed as a result of liquidity problems on three continents in the EU, Japan and the USA and that over 200 million people are believed to have lost their jobs.

IT IS BEING REFLECTED IN PAYMENT TERMS

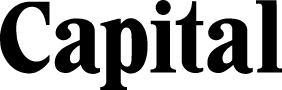

Liquidity squeezes and the fact that many companies are staying very liquid has resulted in a lengthening of payment terms to suppliers in sectors from tourism to logistics, clothing and textiles. For example, in the cosmetics sector the payment terms have lengthened to 120-150 days in 2014 from 6090 days last year.~

In the textile sector, the terms of trade have lengthened from 120-150 days last year to 150-210 days. In the clothing sector, payment terms have lengthened from 90-120 days to 150-180 days.

İsmail Gülle, the president of the Istanbul Textile and Apparel Exporter Association, says: “If you are sure of those you are dealing with, then there is no cause for concern regarding payments and trading.

But we are seeing more checks and the terms have lengthened by 1-2 months. We know that there are some companies whose trading practices we are not sure of which are trying to turn this situation to their advantage.”

WATCH RECEIVABLES

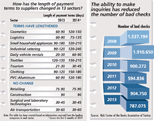

One of the most important consequences of the liquidity squeeze is bad checks. In a statement to banks, the Risk Center of the Banks Association of Turkey said that there were 787,075 unhonored checks at the end of 2013. This figure represents a decline of 13 per cent on the end of 2012.

The main reason is that the abolition of jail terms for those who give bad checks resulted in an increase in offences and the discovery for the credit record center. Credit inquiries, double signatures and the identification of offenders resulted in a decline in the number of bad checks in 2013. But the forecast is still that the problem of receivables could deepen in 2014.~

Sun Tekstil Board Member Sabri Unluturk says that banks have been applying stress tests for heavily indebted companies in the sector and that credit interest rates have risen. Unluturk says that they have seen payment terms lengthen in 2014, increasing from 75 days to 90 days.

He continues: “We are taking two-year insurance on receivables. We are being very careful to ensure that the receivables insurance does not exceed the company’s completed limits and carries the risk to the domestic market. We don’t work with customers who have limitless receivables insurance.”

HOW DO THEY MANAGE RISK?

So how are Turkish businesspeople, who are used to managing crises, dealing with the liquidity squeeze. Vedat Aydin, the president of the Zorlu Holding Textile Group, says that in the current situation, risk management has become one of the most important aspects of their business.

Aydin notes that they have used all of the risk management methods such as open accounts, bank guarantees and real estate mortgages. “The risk factors have increased when compared with previous years,” says Aydin. “I believe that, if we cannot find alternative markets such as exports, then we shall be in an even more difficult position.”

This situation is expected to continue until the end of the year, leaving executives face to face with deadly risks such as a rising exchange rate and a lack of profits, revenue and liquidity.

Tabloyu görmek için görsele tıklayın.

Compared, with last year, there has been a 100 per cent increase in the number of my clients who have been coming to me with requests for bankruptcy. Most demand is coming from the construction sector, its supply industries, and foodstuffs companies.

Compared, with last year, there has been a 100 per cent increase in the number of my clients who have been coming to me with requests for bankruptcy. Most demand is coming from the construction sector, its supply industries, and foodstuffs companies. The major cause of companies reaching this point is liquidity squeezes. They do not have sufficient equity capital. In order to the costs of bank loans they are using factoring companies to discount the checks they have received on their low profits. This is how they are trying to pay their debts to banks.”

These words belong to the lawyer Ali Rıza Yılmaz, who handles suspended bankruptcy cases. The companies that have come to Yılmaz’s attention through their liquidity shortages and which have come to the brink of bankruptcy are not confined to the construction and foodstuffs sectors.

In the last year, there has been a steep rise in the number of companies in diverse sectors seeking suspended bankruptcies, from Rodi to the generator giant the Kırcı Group, the pulses giant Narpa Narin and Verde Yağ.~

It is striking that the basic problem that is bringing companies to the brink of bankruptcy is a shortage of liquidity. This situation is expected to continue until the end of the year, leaving executives face to face with deadly risks such as a rising exchange rate and a lack of profits, revenue and liquidity.

500,000 COMPANIES WENT UNDER

A shortage of liquidity also played the leading role in the global financial crisis that erupted at the end of 2008. The value of the global economy was $60 trillion and the market value was around $600 trillion.

The liquidity problem appeared as a result of the mortgage crisis that began in the USA. At that time, the first bankruptcy as a result of liquidity problems was the $2.6 billion investment bank Bearn Sterns. Later came Basis Capital and the process continued with Absolute Capital, the use of state aid to rescue Fannie Mae and Freddie Mac and the nationalization of investment banks.

The bankruptcy of Lehman Brothers increased the global financial crisis’s liquidity problem. Dr. ismet Demirkol, who is a member of the teaching staff at Bahge§ehir University, says that, during the same process, nearly 500,000 companies collapsed as a result of liquidity problems on three continents in the EU, Japan and the USA and that over 200 million people are believed to have lost their jobs.

IT IS BEING REFLECTED IN PAYMENT TERMS

Liquidity squeezes and the fact that many companies are staying very liquid has resulted in a lengthening of payment terms to suppliers in sectors from tourism to logistics, clothing and textiles. For example, in the cosmetics sector the payment terms have lengthened to 120-150 days in 2014 from 6090 days last year.~

In the textile sector, the terms of trade have lengthened from 120-150 days last year to 150-210 days. In the clothing sector, payment terms have lengthened from 90-120 days to 150-180 days.

İsmail Gülle, the president of the Istanbul Textile and Apparel Exporter Association, says: “If you are sure of those you are dealing with, then there is no cause for concern regarding payments and trading.

But we are seeing more checks and the terms have lengthened by 1-2 months. We know that there are some companies whose trading practices we are not sure of which are trying to turn this situation to their advantage.”

WATCH RECEIVABLES

One of the most important consequences of the liquidity squeeze is bad checks. In a statement to banks, the Risk Center of the Banks Association of Turkey said that there were 787,075 unhonored checks at the end of 2013. This figure represents a decline of 13 per cent on the end of 2012.

The main reason is that the abolition of jail terms for those who give bad checks resulted in an increase in offences and the discovery for the credit record center. Credit inquiries, double signatures and the identification of offenders resulted in a decline in the number of bad checks in 2013. But the forecast is still that the problem of receivables could deepen in 2014.~

Sun Tekstil Board Member Sabri Unluturk says that banks have been applying stress tests for heavily indebted companies in the sector and that credit interest rates have risen. Unluturk says that they have seen payment terms lengthen in 2014, increasing from 75 days to 90 days.

He continues: “We are taking two-year insurance on receivables. We are being very careful to ensure that the receivables insurance does not exceed the company’s completed limits and carries the risk to the domestic market. We don’t work with customers who have limitless receivables insurance.”

HOW DO THEY MANAGE RISK?

So how are Turkish businesspeople, who are used to managing crises, dealing with the liquidity squeeze. Vedat Aydin, the president of the Zorlu Holding Textile Group, says that in the current situation, risk management has become one of the most important aspects of their business.

Aydin notes that they have used all of the risk management methods such as open accounts, bank guarantees and real estate mortgages. “The risk factors have increased when compared with previous years,” says Aydin. “I believe that, if we cannot find alternative markets such as exports, then we shall be in an even more difficult position.”

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?