-

BIST 100

13821,97%0,49En Düşük13821,97En Yüksek0

13821,97%0,49En Düşük13821,97En Yüksek0 -

DOLAR

44,10%0,09Alış44,05Satış44,10En Yüksek44,09

44,10%0,09Alış44,05Satış44,10En Yüksek44,09 -

EURO

51,31%-0,09Alış51,21Satış51,31En Yüksek51,39

51,31%-0,09Alış51,21Satış51,31En Yüksek51,39 -

STERLİN

59,34%0,05Alış59,19Satış59,34En Yüksek59,35

59,34%0,05Alış59,19Satış59,34En Yüksek59,35 -

ALTIN

7540%0Alış7374,51Satış7540En Yüksek7540

7540%0Alış7374,51Satış7540En Yüksek7540

-

BIST 100

0%0,49En Düşük0En Yüksek0

0%0,49En Düşük0En Yüksek0 -

DOLAR

44,08%0,09Alış44,05Satış44,10En Yüksek44,09

44,08%0,09Alış44,05Satış44,10En Yüksek44,09 -

EURO

51,26%-0,09Alış51,21Satış51,31En Yüksek51,39

51,26%-0,09Alış51,21Satış51,31En Yüksek51,39 -

STERLİN

59,27%0,05Alış59,19Satış59,34En Yüksek59,35

59,27%0,05Alış59,19Satış59,34En Yüksek59,35 -

ALTIN

0%0Alış7374,51Satış7540En Yüksek7540

0%0Alış7374,51Satış7540En Yüksek7540

- Anasayfa

- Haberler

- Tüm Haberler

- The great value competition

The great value competition

The global crisis has once again demonstrated the importance of branding.

1.07.2010 00:00:000

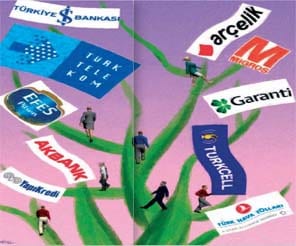

THE RESULTS are out for Capital’s “Most Valuable Brands in Turkey” survey, which has become a tradition. The survey, which was conducted together with Brand Finance, which is one of the leading brand research companies in the world, reveals the value of the 100 brands which are regarded as “select” and “trusted”. The survey, which this year was held for the fifth time, found that there had been no change at the top of the rankings. As had happened last year, Türk Telekom ranked first with a brand value of $1.69 billion. In a surprise rise, İş Bankası came second with a brand value of $1.66 billion. Turkcell, which had ranked second last year, slipped back one place to third with a brand value of $1.62 billion. Arçelik, which we had become accustomed to seeing in the top three over the previous four years, fell back one place to fourth with a brand value of $1.44 billion. Anadolu Efes was fifth with a brand value of $1.37 billion.

It was striking that the total value of the companies in the table had not been affected by the crisis. The total value of the 100 Most Valuable Brands in Turkey rose by $4.019 billion compared with the previous year. The total brand value of the top five firms increased by 13 percent.

HOW IS BRAND VALUE CALCULATED?

In the survey, Brand Finance calculated the values according to the “royalty relief” method. The compensation one company receives for licensing intellectual and industrial rights to another company provides a “royalty relief range”. A “Brand Strength Index” was created based on an analysis of the success of a company’s brand, brand management, brand presence and brand weighting. Each of these indicators is graded on a scale of 0 to 100. The resultant average index is adjusted according to the “royalty relief” range to determine the “royalty relief rate”. The companies’ “probable sales revenue” for the next five years is calculated based on the companies’ sales revenue data and profitability figures for the previous five years. The “royalty relief rate” is adjusted according to the sales revenue. This figure includes calculations based on the royalty relief and future earnings figures. These earnings are then adjusted according to the actual or potential risks associated with the brand, its category and country to determine a “discount rate”.

The “discount rate” is adjusted according to “royalty relief” earnings and the potential revenue from the brand to determine in current values. This research formula belongs to Brand Finance, one of the world’s leading brand valuation companies.

The survey covered companies which are publicly owned and publish data. Questions were sent to leading Turkish companies which are included in the Capital500 list and which are of a significant size but which not meet these two criteria. Companies with products which do not reach end consumers were not included in the survey.

It was striking that the total value of the companies in the table had not been affected by the crisis. The total value of the 100 Most Valuable Brands in Turkey rose by $4.019 billion compared with the previous year. The total brand value of the top five firms increased by 13 percent.

HOW IS BRAND VALUE CALCULATED?

In the survey, Brand Finance calculated the values according to the “royalty relief” method. The compensation one company receives for licensing intellectual and industrial rights to another company provides a “royalty relief range”. A “Brand Strength Index” was created based on an analysis of the success of a company’s brand, brand management, brand presence and brand weighting. Each of these indicators is graded on a scale of 0 to 100. The resultant average index is adjusted according to the “royalty relief” range to determine the “royalty relief rate”. The companies’ “probable sales revenue” for the next five years is calculated based on the companies’ sales revenue data and profitability figures for the previous five years. The “royalty relief rate” is adjusted according to the sales revenue. This figure includes calculations based on the royalty relief and future earnings figures. These earnings are then adjusted according to the actual or potential risks associated with the brand, its category and country to determine a “discount rate”.

The “discount rate” is adjusted according to “royalty relief” earnings and the potential revenue from the brand to determine in current values. This research formula belongs to Brand Finance, one of the world’s leading brand valuation companies.

The survey covered companies which are publicly owned and publish data. Questions were sent to leading Turkish companies which are included in the Capital500 list and which are of a significant size but which not meet these two criteria. Companies with products which do not reach end consumers were not included in the survey.

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?