-

BIST 100

13821,97%0,49En Düşük13821,97En Yüksek0

13821,97%0,49En Düşük13821,97En Yüksek0 -

DOLAR

44,10%0,09Alış44,05Satış44,10En Yüksek44,09

44,10%0,09Alış44,05Satış44,10En Yüksek44,09 -

EURO

51,31%-0,09Alış51,21Satış51,31En Yüksek51,39

51,31%-0,09Alış51,21Satış51,31En Yüksek51,39 -

STERLİN

59,34%0,05Alış59,19Satış59,34En Yüksek59,35

59,34%0,05Alış59,19Satış59,34En Yüksek59,35 -

ALTIN

7540%0Alış7374,51Satış7540En Yüksek7540

7540%0Alış7374,51Satış7540En Yüksek7540

-

BIST 100

0%0,49En Düşük0En Yüksek0

0%0,49En Düşük0En Yüksek0 -

DOLAR

44,08%0,09Alış44,05Satış44,10En Yüksek44,09

44,08%0,09Alış44,05Satış44,10En Yüksek44,09 -

EURO

51,26%-0,09Alış51,21Satış51,31En Yüksek51,39

51,26%-0,09Alış51,21Satış51,31En Yüksek51,39 -

STERLİN

59,27%0,05Alış59,19Satış59,34En Yüksek59,35

59,27%0,05Alış59,19Satış59,34En Yüksek59,35 -

ALTIN

0%0Alış7374,51Satış7540En Yüksek7540

0%0Alış7374,51Satış7540En Yüksek7540

- Anasayfa

- Haberler

- Tüm Haberler

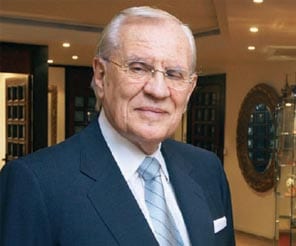

- What did Erdoğan Demirören learn from the crisis?

What did Erdoğan Demirören learn from the crisis?

” He believes that, despite there being significant possibilities, the number of entrepreneurs is still small.

1.10.2010 00:00:000

Capital: You were very young when you started in business. What differences do you see between the business world as it was then and how it is today?

- At that time, the realities were very different. In those days it was difficult to find an entrepreneur. It is not easy to find entrepreneurs in a country which does not accumulate capital. It is not easy to develop an economy which is not consumption-based. One should not forget those times... There were also economic factors in the reasons for the 1960 coup.

Capital: How was the profile of a businessman different to today?

- Today it is easier to become an entrepreneur... The single factor which links the society of those times and the current environment is creativity and the struggle to be successful. Of course, the spirit of enterprise was present as it is today. Unfortunately, today in Turkey, despite there being significant possibilities, the number of entrepreneurs is still small. The younger generation don’t want to be entrepreneurs. When the new generation of entrepreneurs see the difficulties in the production sector, they turn to simpler things, such as entering areas which are service or technology oriented.

Capital: You said that there are significant possibilities in Turkey today. What are they?

- At the moment, if a new entrepreneur in Turkey is planning an investment and wants to become involved in a high tech area, then he has some great opportunities. In 1950-55, when we wanted to get a loan from a bank, the interest rate was 18-23 percent. Today it is 7-9 percent. Today, even if there is a crisis, there are so many financing opportunities... Loans for up to ten years can be found either domestically or from abroad. The interest rates on foreign exchange loans are 2.75 – 4.25 percent, while on TL they are in the 7-9 percent band. See how far we have come..,

Capital: Why, despite the opportunities, don’t entrepreneurs make investments?

- Nobody makes investments because Turkish entrepreneurs are intimidated by the problems and the mentality. You struggle for one year to get a license for a factory... Under these conditions, why would an entrepreneur pour money into this? Naturally enough, the capital moves abroad.

Capital: Do you see this as a negative development?

- Yes, it is a very negative development of course... When there are so many sectors, so many areas that are untouched, why not invest in Turkey? When we refer to industry, we are also including agribusiness. The one thing that can save us is agribusiness. If the Harran Plain can be properly organized then it will create employment for four million people.

Capital: How do you evaluate the steps that the Turkish business community has taken towards globalization?

- Turkey is the country with the youngest population, the strongest entrepreneurial spirit and also the country with the most areas suitable for investment in the EU. It is because Turkey does not have enough accumulated capital that we have such a need of money from abroad. We need to develop and produce many projects using every kind of investment model, including build-operate-transfer.

Capital: Where does Turkey stand today as regards the crisis?

- We survived the latest economic crisis very comfortably. The reason is the reform of the banking sector in 2001. The measures that were taken transformed a rentier economy into a real economy based on savings and investment. Now the rules of the real economy are operating in Turkey.~

Capital: Do you expect a second global crisis?

- Yes, I do. After Greece and Portugal, there is a possibility of a crisis in Belgium, Germany, Britain and France. The economies in these countries are not going well.

Capital: As far as I can understand, you are positive about the Turkish economy?

- The last ten years have been an unprecedentedly good period for Turkey. I think that this government has been very good in terms of the economy. Even if there is a second crisis, it won’t affect Turkey. Turkey is on the rails.

Capital: What kind of company will survive in this environment?

- The companies that will survive will be those which monitor their business well, closely follow technology and organize their infrastructure very well. Turkey learned to be productive as a result of this crisis. We have made a lot of progress in terms of productivity.

Capital: What do you think are the greatest mistakes made by family companies in Turkey?

- It is jealousy that brings down all family companies. Families which cannot tame jealousy have no chance. You should pay a lot of attention to raising the next generation very well. You should make them get used to saving at a very young age.

Capital: Are there any new areas that you at the Demirören Group are planning to enter?

- We want to make an investment in energy. We have entered thermal energy. We shall produce energy from thermal water in 12 regions of Turkey. At the moment, we have established the company and I think that in the future we shall take a foreign partner. We are also thinking of acquiring a company in the energy sector in the future. We have plans in the fields of energy, natural gas and the environment as a country strategic partnership.

- At that time, the realities were very different. In those days it was difficult to find an entrepreneur. It is not easy to find entrepreneurs in a country which does not accumulate capital. It is not easy to develop an economy which is not consumption-based. One should not forget those times... There were also economic factors in the reasons for the 1960 coup.

Capital: How was the profile of a businessman different to today?

- Today it is easier to become an entrepreneur... The single factor which links the society of those times and the current environment is creativity and the struggle to be successful. Of course, the spirit of enterprise was present as it is today. Unfortunately, today in Turkey, despite there being significant possibilities, the number of entrepreneurs is still small. The younger generation don’t want to be entrepreneurs. When the new generation of entrepreneurs see the difficulties in the production sector, they turn to simpler things, such as entering areas which are service or technology oriented.

Capital: You said that there are significant possibilities in Turkey today. What are they?

- At the moment, if a new entrepreneur in Turkey is planning an investment and wants to become involved in a high tech area, then he has some great opportunities. In 1950-55, when we wanted to get a loan from a bank, the interest rate was 18-23 percent. Today it is 7-9 percent. Today, even if there is a crisis, there are so many financing opportunities... Loans for up to ten years can be found either domestically or from abroad. The interest rates on foreign exchange loans are 2.75 – 4.25 percent, while on TL they are in the 7-9 percent band. See how far we have come..,

Capital: Why, despite the opportunities, don’t entrepreneurs make investments?

- Nobody makes investments because Turkish entrepreneurs are intimidated by the problems and the mentality. You struggle for one year to get a license for a factory... Under these conditions, why would an entrepreneur pour money into this? Naturally enough, the capital moves abroad.

Capital: Do you see this as a negative development?

- Yes, it is a very negative development of course... When there are so many sectors, so many areas that are untouched, why not invest in Turkey? When we refer to industry, we are also including agribusiness. The one thing that can save us is agribusiness. If the Harran Plain can be properly organized then it will create employment for four million people.

Capital: How do you evaluate the steps that the Turkish business community has taken towards globalization?

- Turkey is the country with the youngest population, the strongest entrepreneurial spirit and also the country with the most areas suitable for investment in the EU. It is because Turkey does not have enough accumulated capital that we have such a need of money from abroad. We need to develop and produce many projects using every kind of investment model, including build-operate-transfer.

Capital: Where does Turkey stand today as regards the crisis?

- We survived the latest economic crisis very comfortably. The reason is the reform of the banking sector in 2001. The measures that were taken transformed a rentier economy into a real economy based on savings and investment. Now the rules of the real economy are operating in Turkey.~

Capital: Do you expect a second global crisis?

- Yes, I do. After Greece and Portugal, there is a possibility of a crisis in Belgium, Germany, Britain and France. The economies in these countries are not going well.

Capital: As far as I can understand, you are positive about the Turkish economy?

- The last ten years have been an unprecedentedly good period for Turkey. I think that this government has been very good in terms of the economy. Even if there is a second crisis, it won’t affect Turkey. Turkey is on the rails.

Capital: What kind of company will survive in this environment?

- The companies that will survive will be those which monitor their business well, closely follow technology and organize their infrastructure very well. Turkey learned to be productive as a result of this crisis. We have made a lot of progress in terms of productivity.

Capital: What do you think are the greatest mistakes made by family companies in Turkey?

- It is jealousy that brings down all family companies. Families which cannot tame jealousy have no chance. You should pay a lot of attention to raising the next generation very well. You should make them get used to saving at a very young age.

Capital: Are there any new areas that you at the Demirören Group are planning to enter?

- We want to make an investment in energy. We have entered thermal energy. We shall produce energy from thermal water in 12 regions of Turkey. At the moment, we have established the company and I think that in the future we shall take a foreign partner. We are also thinking of acquiring a company in the energy sector in the future. We have plans in the fields of energy, natural gas and the environment as a country strategic partnership.

Türkiye ve dünya ekonomisine yön veren gelişmeleri yorulmadan takip edebilmek için her yeni güne haber bültenimiz “Sabah Kahvesi” ile başlamak ister misiniz?